For many people, investing in real estate feels out of reach because of one major barrier: credit history. Traditional lenders rely heavily on credit scores, making it difficult for individuals with limited or damaged credit to qualify for standard mortgages. This has led to growing interest in the idea of buying investment property with no credit check.

While it is possible in certain situations, it is often misunderstood. There is no magic shortcut that removes risk, responsibility, or due diligence. Instead, no-credit-check property purchases usually involve alternative structures, higher expectations from sellers or lenders, and careful negotiation.

This article explains what “no credit check” really means, how these transactions work, and what investors should realistically consider before moving forward.

What “No Credit Check” Really Means

The phrase “no credit check” can be misleading.

No Credit Check Does Not Mean No Evaluation

In most cases, it means:

- No traditional bank credit score review

- Greater focus on the property or cash flow

- Alternative qualification criteria

Sellers or private lenders still evaluate risk—just differently.

Why Traditional Lenders Rely on Credit

Banks use credit scores to:

- Predict repayment behavior

- Meet regulatory requirements

- Reduce default risk

When banks step away, other parties step in with different rules.

Why Investors Look for No Credit Check Options

There are several reasons investors explore this path.

Past Credit Challenges

Life events such as medical bills, business failure, or job loss can damage credit even for responsible individuals.

Self-Employed or Irregular Income

Traditional lenders may struggle to evaluate non-standard income streams.

Speed and Flexibility

Alternative financing can sometimes close faster than bank loans.

Common Ways to Buy Investment Property Without a Credit Check

There are several legitimate approaches, each with trade-offs.

Seller Financing

Seller financing is one of the most common no-credit-check methods.

How Seller Financing Works

Instead of borrowing from a bank:

- The seller acts as the lender

- The buyer makes payments directly to the seller

- Terms are negotiated privately

The seller may or may not review credit, depending on comfort level.

Why Sellers Agree

Sellers may offer financing if:

- The property has been on the market for a long time

- They want steady income instead of a lump sum

- They wish to defer taxes

Rent-to-Own or Lease Options

Another approach involves renting with an option to buy later.

How Rent-to-Own Works

- Buyer rents the property

- A portion of rent may apply toward purchase

- Purchase price is often set in advance

Credit checks may be minimal or postponed.

Risks to Understand

- Option fees may be non-refundable

- Purchase is not guaranteed

- Terms must be clearly documented

Legal review is strongly recommended.

Private Money and Hard Money Lenders

Private lenders focus more on the property than the borrower.

Asset-Based Lending

These lenders emphasize:

- Property value

- Down payment size

- Exit strategy

Credit may be reviewed lightly or not at all.

Higher Costs Are Common

Interest rates and fees are often higher to compensate for risk.

Partnerships and Joint Ventures

Partnering with others can bypass personal credit limitations.

How Partnerships Work

One partner may provide:

- Capital or credit

- Experience or management

The other partner may handle operations or sourcing deals.

Clear Agreements Are Essential

Written agreements protect all parties and prevent disputes.

Paying Cash or Using Large Down Payments

Cash purchases eliminate credit concerns entirely.

Why Cash Reduces Barriers

- No lender approval required

- Faster closing

- Strong negotiating position

Large down payments may also reduce the need for credit checks.

Why No Credit Check Deals Often Cost More

Flexibility usually comes at a price.

Higher Interest Rates

Private financing reflects increased risk.

Shorter Loan Terms

Many alternative loans are short-term and require refinancing later.

Less Consumer Protection

Traditional mortgage regulations may not apply.

Understanding these trade-offs is critical.

Due Diligence Is Even More Important

No credit check does not mean no responsibility.

Property Analysis Matters More

Investors must carefully evaluate:

- Market value

- Rental demand

- Repair costs

- Local regulations

Mistakes can be costly.

Legal and Contract Considerations

Alternative financing relies heavily on contracts.

Professional Review Is Essential

Real estate attorneys help:

- Clarify ownership rights

- Prevent unfair terms

- Ensure compliance with local laws

Skipping this step increases risk.

Avoiding Scams and Unrealistic Promises

The phrase “no credit check” attracts bad actors.

Warning Signs

Be cautious if:

- Guarantees of approval are made

- Fees are demanded upfront with no transparency

- Pressure tactics are used

If it sounds too easy, it usually is.

Is Buying Without a Credit Check Sustainable?

For some investors, yes—but not forever.

Temporary Strategy

Many investors use alternative financing to:

- Acquire property

- Improve cash flow

- Refinance later with traditional lenders

Credit improvement often remains a long-term goal.

Improving Credit While Investing

Real estate investing and credit rebuilding can happen together.

Positive Cash Flow Helps

Rental income can:

- Improve financial stability

- Reduce debt

- Support future financing

Over time, better options may become available.

When This Strategy Makes Sense

Buying investment property with no credit check may suit:

- Experienced investors

- Buyers with strong cash flow

- Those comfortable with negotiation and complexity

It is less suitable for beginners seeking simplicity.

Ethical and Practical Responsibility

Even without a credit check, obligations remain.

Long-Term Commitments

Missing payments affects relationships, legal standing, and future opportunities.

Reputation Matters

In private deals, trust and credibility are valuable assets.

Final Thoughts

Buying investment property with no credit check is possible, but it is not effortless or risk-free. It requires creativity, negotiation, careful analysis, and often higher costs. These strategies are tools—not shortcuts.

For disciplined investors who understand the risks and responsibilities, alternative financing can provide access to real estate opportunities. For others, improving credit and preparing for traditional financing may be the safer path.

The most important lesson is this: financial flexibility comes from preparation, not avoidance. Whether through credit improvement or smart structuring, sustainable investing is built on knowledge, patience, and realistic expectations.

Summary:

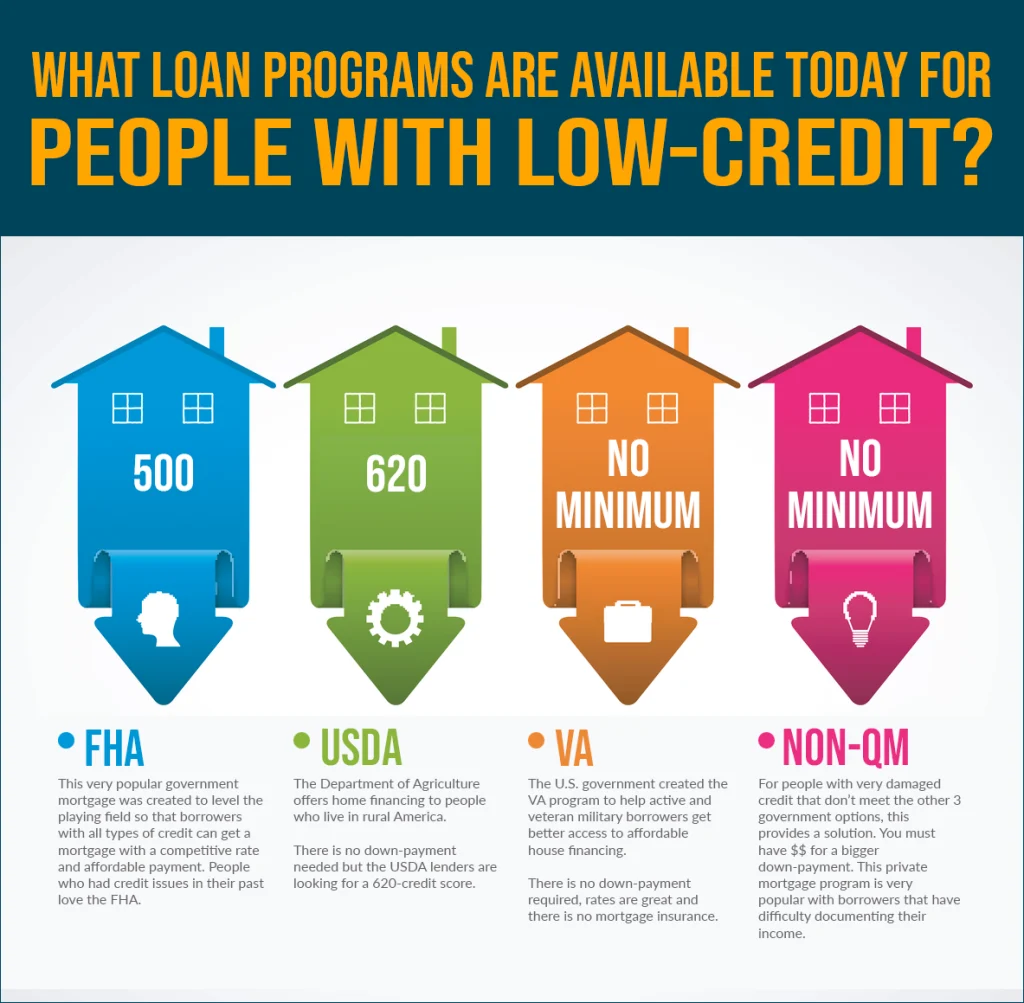

Low down payments, no credit check and guaranteed approval. This is the convenience for many investment property buyers who choose to shop online. With the internet being responsible for dramatically changing the way people do business, it is also responsible for revolutionizing the way people shop for investment property.

A conventional loan for investment property would entail an application, credit review and complete disclosure of the applicants financial situation. Ho…

Keywords:

investment property

Article Body:

Low down payments, no credit check and guaranteed approval. This is the convenience for many investment property buyers who choose to shop online. With the internet being responsible for dramatically changing the way people do business, it is also responsible for revolutionizing the way people shop for investment property.

A conventional loan for investment property would entail an application, credit review and complete disclosure of the applicants financial situation. However, an increasing number of real estate developers, owners and brokers are offering investment property with the convenience of owner financing. A low down payment, which is followed by regular monthly payments, may result in a prime piece of investment property. Most commonly used for purchases of land, owner financing is extremely popular for investors, first-time home builders with no credit or even individuals who have past credit problems and would not otherwise qualify for a conventional loan.

With very low down payments, which are often lower than $1,000.00, many investment property sellers provide competitive interest rates and low monthly payments with absolutely no qualifying, credit check or income verification. As long as consumers continue to make their minimum required monthly payment, they will be approved.

No matter when, where or how investment property is purchased, the buyer must perform due diligence prior to signing on the dotted line. The buyer will want to make sure that he/she will receive a warranty deed on any investment property, which means it will be free and clear of any liens, and that the current owner has the full right to sell the property. In addition, it may be a good idea for the potential buyer to contact the local tax office and inquire about the most recent assessment of the investment property. This will give the buyer a good idea as to whether or not he/she is getting a bargain. If the investment property is located in another state, the buyer should request photos and even consider hiring a video professional to make a recording of the immediate area and the land for visual purposes.

When agreeing to purchase investment property with owner financing, a signed contract is a must. This is simply a contract that is drawn and signed by both parties, which will indicate the down payment required, full purchase price, monthly payments, number of payments required until payoff, a listing of pre-payment penalties (if applicable), the location of the investment property and the size and details of the same.

A valid investment property contract will confirm that the seller agrees to finance the property at a certain amount of interest and will sell the described property after a predetermined number of payments. In return, the buyer agrees to pay a certain amount each month on a specified day each month. The contract should outline the exact location, street address, size of the lot and parcel number. In addition, it must include terms regarding late or missed payments, late fees and cancellation options (if any). The contract must be signed and dated by both parties in order for it to be valid.

Leave a Reply