After mastering the basics of financial security—understanding your money, building an emergency fund, and controlling high-interest debt—you are ready to move forward. Steps 4 to 6 focus on growth, protection, and long-term stability. These steps transform financial security from simple survival into sustainable progress.

Financial security is not just about avoiding problems. It is about creating options, resilience, and freedom over time.

Step 4: Build Consistent Savings and Long-Term Goals

Once debt is under control and emergencies are covered, saving becomes more intentional.

Move Beyond Emergency Savings

At this stage, saving is no longer only for surprises. It becomes a tool for:

- Short-term goals (vacations, education, major purchases)

- Medium-term goals (home down payment, business capital)

- Long-term goals (retirement, financial independence)

Each goal should have a clear purpose and timeline.

Pay Yourself First

One of the most effective habits for financial security is paying yourself first.

This means:

- Saving automatically when income arrives

- Treating savings like a non-negotiable expense

- Reducing reliance on leftover money

Automation removes emotion and builds consistency.

Separate Savings by Purpose

Separating savings accounts by goal can improve clarity and discipline. When each fund has a purpose, you are less likely to spend it impulsively.

Saving consistently builds confidence and momentum.

Step 5: Invest Wisely for Long-Term Growth

Saving protects money. Investing helps money grow.

At this stage, investing becomes appropriate because your foundation is stable.

Understand Why Investing Matters

Inflation slowly reduces the value of cash over time. Investing helps:

- Preserve purchasing power

- Build wealth gradually

- Support long-term financial independence

Investing is not about quick profits—it is about patience.

Start Simple and Stay Consistent

You do not need complex strategies to begin.

Healthy investing habits include:

- Diversification across assets

- Long-term focus rather than short-term speculation

- Regular contributions over time

Consistency often matters more than perfect timing.

Match Investments to Your Risk Tolerance

Financial security improves when investments match your comfort level.

Ask yourself:

- How much volatility can I tolerate?

- What is my time horizon?

- Do I understand what I’m investing in?

Avoid chasing trends or promises of fast returns.

Why Investing Should Come After the Basics

Investing without emergency savings or debt control often leads to stress. Market downturns can force poor decisions if money is needed urgently.

Steps 1 to 4 ensure that investments can remain untouched during difficult times.

Step 6: Protect What You Are Building

As your financial life grows, protection becomes essential.

Insurance as a Financial Security Tool

Insurance is not an investment, but it is a critical safeguard.

Common forms of protection include:

- Health insurance

- Life insurance

- Disability coverage

- Property and liability insurance

These tools protect years of progress from unexpected events.

Estate and Financial Planning Basics

Financial security also includes planning for the unexpected future.

Basic steps may include:

- Naming beneficiaries

- Creating a simple will

- Organizing financial documents

These actions reduce confusion and stress for loved ones.

Reduce Concentration Risk

Avoid having all your financial resources in one place.

Diversification applies to:

- Income sources

- Investments

- Assets

Balance increases resilience.

How Steps 4 to 6 Work Together

These steps are interconnected:

- Saving creates opportunity

- Investing creates growth

- Protection preserves progress

Together, they turn financial security into financial sustainability.

Common Mistakes at This Stage

Overcomplicating Investments

Complexity often increases risk rather than returns.

Ignoring Protection

Many people focus on growth but forget to protect what they’ve built.

Becoming Overconfident

Discipline matters at every stage, regardless of progress.

Financial Security Is a Long-Term Process

Steps 4 to 6 do not end the journey—they strengthen it.

Markets will change. Life will surprise you. But a strong system allows you to adapt without panic.

Financial security is not about predicting the future. It is about being prepared for it.

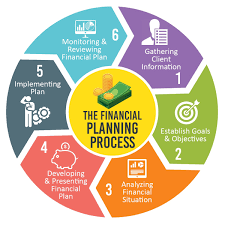

Putting All Six Steps Together

- Understand your money

- Build an emergency fund

- Control high-interest debt

- Save with intention

- Invest for long-term growth

- Protect your financial foundation

Each step supports the next.

Final Thoughts

Building financial security is about balance—between discipline and flexibility, growth and protection, ambition and patience.

Steps 4 to 6 help you move from stability to confidence. They allow your money to work for you while reducing the impact of unexpected events.

Financial security is not measured by how fast you grow, but by how well you endure and adapt over time.

Summary:

Discusses the wealth building principles of goal setting, budgeting and self education.

Keywords:

goals,goal setting,budget,budgeting,investment,property investment

Article Body:

- Learn to Set Goals

Most self made, successful business people and investors have achieved their success by planning to do so.

They have set goals for themselves and achieved them. They invest time in reading and learning about wealth creation and are happy to learn from other people�s mistakes and experiences, as well as their own. They set goals, and realise that they will be far better able to achieve them if they familiarise themselves with the ways in which other people acted and the things that others have done to succeed. Wealthy people create wealth by carefully utilising the income that they have available to them to their best advantage. They know that working harder and longer hours is not the way to achieve financial freedom, instead they have to utilise what they have, and make it grow.

Having a goal enables you to focus your energies on devising ways to achieve it. When someone makes a decision and begins focusing on achieving a specific goal (and even better in a specific period of time), the powerful subconscious mind goes to work and begins playing with ideas and developing strategies of various ways to bring about the successful completion of the goal.

When you set yourself a goal both your conscious and subconscious start working on it and begin to develop an action plan. You will begin asking yourself questions about what needs to be done to enable you to reach your goal. Many find themselves coming up with amazing ideas and solutions to problems or obstacles that have been in the way of achieving their goal. The subconscious is an extremely powerful tool. The more often you remind yourself of your goal, the more your mind will work on ways for you to achieve it. Some people find answers come to them when they are asleep and dreaming.

Have you ever noticed that there is no correlation between being wealthy and having a high IQ or a university degree? If there were, every doctor and university graduate would be wealthy, and as statistics show, most of them end up in the same situation as 95% of the population.

Setting Goals helps you to focus your energy on developing workable strategies. Setting long term goals helps you look at the big picture. Once you can see the big picture, you can develop small sub goals. Sub goals are small simple goals that can be followed one step at a time. When you progressively achieve your sub goals, you will get closer and closer to your major goals. Goals are simply plans to succeed. It is said that if you �Fail to plan, then you plan to fail�. Goals help you keep motivated. Progressively achieving your goals can lead to a wonderful feeling of fulfilment.

- Learn how to Budget.

Budgeting does not have to be tedious. All you need to do is to work out:

What your incomings are. What your regular outgoings are and then make sure that all of your other expenditure is less than the amount remaining. This will allow you to start saving and investing. Budgeting puts you in control of your finances.

- Learn about investing � in particular about property investing.

Learn to research the property market, so that you will be able to purchase properties that will not only give a good rental yield, but they will also return the best capital growth possible. Read investment books. Read auto-biographies of successful people. Speak to people who have succeeded in doing what it is that you want to do. The more you learn, the easier it will be to recognise a good investment.

Find out about Negative, Neutral and Positive gearing � and why gearing is an invaluable tool, which will enable you to build up a wealth base in accelerated time, compared to if you only invested your own hard earned dollars.

Once you have educated yourself and understand why investing in property is such a powerful tool, you will be able to embark on the road to financial security.

In Australia, and many other countries less than 5% of the population reach retirement able to support themselves, without government or family assistance. If you want to be one of them, then now is the best time to start striving toward financial security.

Leave a Reply